How students can start investing

Beginning early can yield greater returns

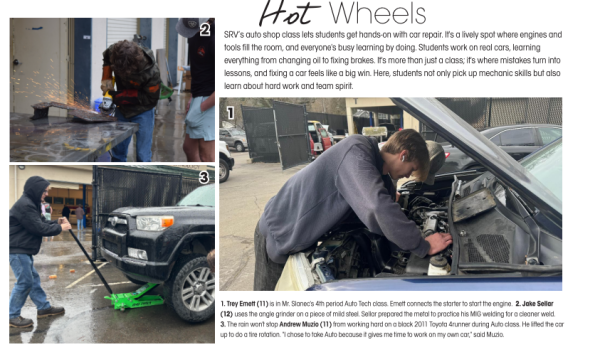

Illustration by Manasvi Dotiyal

Eugene Harold Krabs watches in glee as his investments skyrocket in value. Krabs invested early while he was a student.

Investing might seem like a task to put on hold until you are well into your adulthood. But learning how to invest early gives you an advantage as your money grows exponentially while you learn many concepts about money and how the financial markets work.

The stock market is essentially a marketplace where you can buy bits of a company. These bits are referred to as shares and are bought and sold every day by individuals and institutions alike.

The stock market, or stock exchange, has allowed entrepreneurs and companies to raise money for ventures since the 16th century, with investors hoping for a return on their investment if the venture succeeds while risking losing their money if it fails.

When people buy 10 shares of Apple, they now own a piece of Apple. That means when Apple profits off of millions of iPhones and MacBooks a year, investors will share in the gains too. Similarly, if Apple doesn’t have a great year, investors will share the losses.

There are many different strategies when it comes to investing. Some investors might deeply research a company and create models. Others might focus on particular economic sectors, such as technology or manufacturing, and see which one has the potential to be the most lucrative.

But as first-time investors, many people don’t have the time or the skill set (yet) to read financial statements. Instead, they should take a more long-term approach to investing. Focus on diversification, or spreading money across various investments, to reduce risk.

“You could buy an individual company, you can buy an ETF, but I think more importantly you should understand why you’re buying it,” said junior Veerein Pala, who invests in the stock market and is the co-president of the Cal High Investment Club. “I would say ETFs are the best solution for someone who’s young, [and] doesn’t have a lot of time.”

ETF stands for Exchange Traded Fund, which is an investment that lets investors own stakes in multiple companies without having to buy shares of those individual companies, ensuring diversification.

For example, the Vanguard 500 Index Fund ETF (VOO) is a fund managed by Vanguard with investments in the S&P 500. By buying just one share of this ETF, people invest in the top 500 companies in the US, making their investment diverse and secure. Even if one company, or an entire sector, were to perform poorly, VOO wouldn’t be significantly impacted.

The stock market has an average annual return of 10 percent, or 6-7 percent when adjusted for inflation over a long time. This might not seem like a lot given that some individual companies can have a return of up to 20 percent or more in one year (if not one month!). But investing consistently in ETFs and keeping a diverse portfolio is viewed by some as a fool-proof strategy and the best way to start off as an investor while avoiding huge risks.

Ditch the notion of ‘get rich quick’. Sometimes what appears to be perfect on the surface is a mess underneath. Internet gurus prevalent on social media platforms such as TikTok (not a great place to get financial advice), Instagram, and YouTube might offer advice like, “If you had invested $100 in Tesla back in some date in the past, you would now have $10,000! Now buy this company!”

While these claims might turn out true, nobody, not even God, can predict what the future of the stock market will be.

“Anything where they always promise everything under the sun, you have to question,” Introduction to Business teacher Chris Doherty said. “You just can’t take things from face value.”

Doherty’s Intro to Business class has learned the importance of this lesson. By watching videos on fraudulent companies like Theranos, or more recently FTX, who have deceived investors, students have gained a better understanding of how to go about investing.

Some years, the economy might see tremendous growth, also known as a bull market, while other years the economy might suffer a bear market and tank. But if investors diversify their money through ETFs, while occasionally risking buying shares in companies they believe in (not the ones that Internet gurus claim will create millionaires overnight), investors will start to appreciate the stock market as their money will grow steadily.

As legendary billionaire investor Warren Buffet said, “Successful investing takes time, discipline, and patience”.

Students get to learn more about how the stock market works when they take economics during senior year. In the class, students get the opportunity to make a mock portfolio in which they research different economic sectors other than the big ones like tech.

“Some of [the sectors] are gonna be ones [they] already know about,” Cal economics teacher Patrick Dwyer said. “But if you give them a different economic sector, say construction or something like that, the names of these companies might be a bit more obscure.”

As students research their assigned economic sector by looking at various companies and how they performed individually, they eventually gain a better understanding of how the market works and how everything is connected.

“[The stock market] is like a clock. You see the face of the clock and you see the arms ticking,” Dwyer said. “But behind the scenes, there’s a whole bunch of gears and things that are working to make everything work, that you don’t necessarily see or think [about].”

So how can you start investing today? Many brokerages offer what are called custodial accounts, which let minors invest under their parents supervision. Companies such as Charles Schwab, Fidelity, ETrade, and Vanguard offer these custodial accounts or similar variations.

Students can open these accounts, deposit money, and are good to go. Welcome to the wonderful world of investing!

Abhinav Purohit is co-president of Cal’s Investment Club.

Senior Abhinav Purohit is back for year three as the Social Media & Video Production Editor for The Californian. This year he hopes to strengthen the...