Rising college costs

Students struggle to pay increasing college tuition

The FAFSA , or Free Application for Federal Student Aid, is a form filled out by college-bound students across the country.

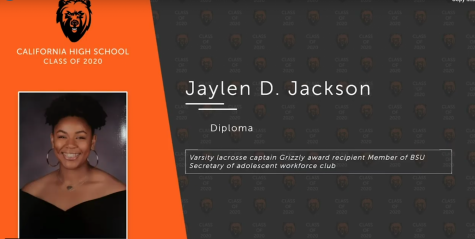

It is a warm, summer day. Hundreds of students are packed in the stadium anticipating the moment that they have been waiting for years to experience: to finally graduate high school, and plunge headfirst into the world of college.

For some, it will be a dream come true. For others, it will be their worst nightmare.

The reason the venture into the realm of college is one that many of today’s graduates dread is the inflating price tag attached to college tuition.

“I think it’s ridiculous,” said senior Tori Tays.

The topic of rising college costs has been a subject of debate for a very long time. Colleges have been reaching deeper and deeper into students’ wallets for decades, and how far they reach has increased, as Chris Torrey, a campus supervisor, points out.

“It’s probably about 30% higher,” he said, in comparison to the time he went to college. Teens are forced to take out loans and apply for scholarships simply to pay for tuition.

Students and economists alike have discussed the issue, but have largely come up empty-handed as to the real reason why the price tag of going to college has bloated over time.

However, William Bennett a 72-year-old writer and radio host, may have an answer.

Bennett, who served as the Secretary of Education under Ronald Reagan, claimed in a 1987 New York Times Op-Ed that “increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions.”

Grey Gordon of Indiana University and Aaron Hedlund of the University of Missouri decided to put this theory to the test in a paper titled, “Accounting for the Rise in College Tuition.”

They discovered, ironically, that increases in loans to students by the government intended to ease the cost of attending college actually push the cost of tuition upwards.

The study also found that not only do increased federal loans proliferate college tuition, but they also drive down the enrollment rate.

Another study performed by the Federal Reserve Bank of New York discovered that for every dollar awarded in Pell Grants, schools raise their tuition by 55 cents. For every dollar shelled out in subsidized loans, it’s 65 cents.

Sounds confusing? Here’s a simple explanation:

The government, over the course of several decades, has given out millions of dollars in financial aid.

Colleges, seeing that because students have more money because of the increased aid, raise tuition. Future students then have to borrow even more money to compensate for the surge in costs.

What results is an extremely destructive cycle.

The government continues loaning money, students keep borrowing, and colleges continue to hike tuition.

“I think it’s a very messed up paradox,” said senior Demetri Georgiades. “It won’t stop unless a generation is willing to not accept loans.”

Another question that arises from this crisis is where all that money is going.

Asked about how much of college tuition goes to instruction, senior Gene Fahey guessed “about 5 percent.”

In reality, about 27% of college tuition goes to instruction, according to the National Center for Education Statistics.

12% goes to research, 11% to hospital services, 9% to auxiliary enterprises, 8% to institutional support, 7% to academic support, and the remaining 26% going to other miscellaneous expenses.

Fahey’s response demonstrates a clear lack of transparency between colleges and their applicants.

Students borrow, which in turn causes an increase in prices. Moreover, high school graduates appear to not have a good idea of where that money is going.

It is a truly sad case, one that is so far resulting in more and more student debt, and fewer and fewer students having access to affordable higher education.